Easy and powerful way to watch/listen 24/7.

Enjoy our 108 Praise Radio platform, we provide you cutting egde content, music and etc.

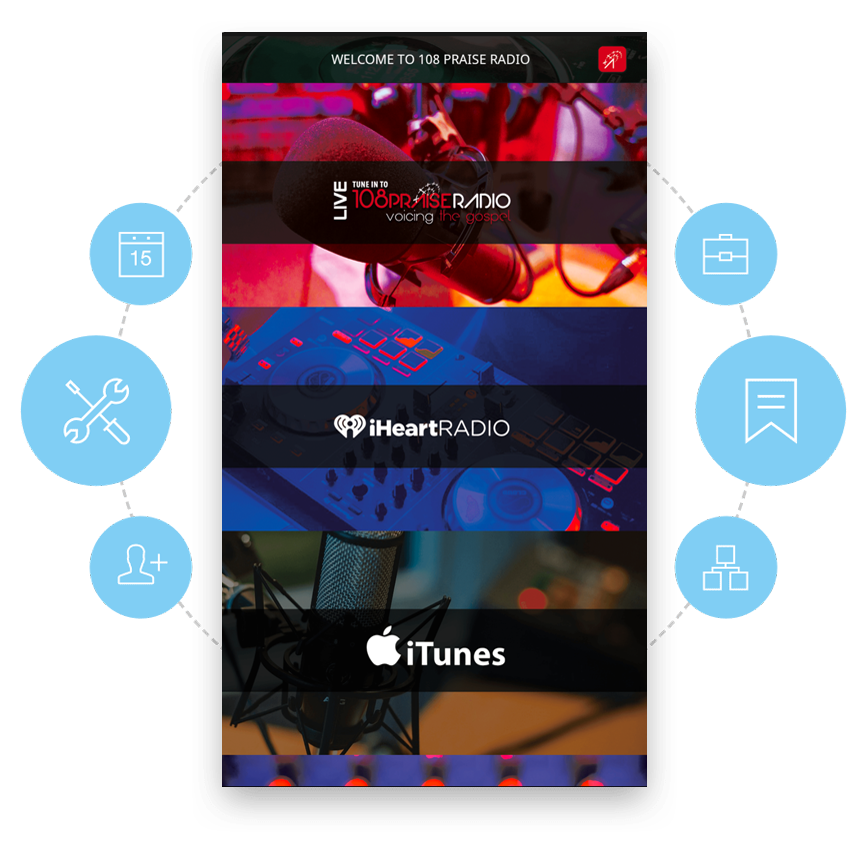

Explore amazing features

Downloaded the app to watch live, listen to streaming music 24/7 and etc.

LIVE broadcast

Our listeners can listen to 108 Praise Radio live as we broadcast from inside or outside of the studio. A virtual experience that brings you face-to-face with 108 Praise Radio music and content.

Mp3 (Audio)

We support these audio files on our platform: MP3, WMA and WAV.

Broadcast

When 108 Praise Radio broadcasts goes live, we stream on multi-platforms such as 365Live, TuneIn and 108 Praise Radio apps.

Stay-in-tune 24/7

Listen anytime, anywhere. Our shows are saved in the app archives so our audience can listen.

New Artist Playlist

Join our PLAYLIST anytime and artists can upload their music and videos to the apps.

All of the music is reported through MediaBase.

Listen to On-Demand

Listen to our on-demand content on iHeart, iTunes, TuneIn, Spotify and Google Podcast.

Audience

The audience can listen to the app on multiple devices, tablets, TV and in the car on bluetooth.

Become a Host

Create your own show on 108 Praise Radio and allow the world to listen to your show.

Analytics

We track every show on 108 Praise Radio, with demographics from around the world.

Click to listen now

Listen to the best music, shows and new artists 24/7.

Always be the first to know

Stay in touch with us!

DROP US A LINE

If you have any questions about our app, becoming a host, submitting your music and etc, please send us a note below and someone will reach out to you.